Visa and Mastercard Applications to People’s Bank of China for Payment Networks

After a decade of lobbying to gain local access to the $124 trillion Chinese payments market, Visa and Mastercard have been snubbed by China’s central bank which has refused to acknowledge applications submitted the payments networks which would allow them to process renminbi payments, despite rules in 2017 that removed formal obstacles to foreign participation in the market. The application delays highlight complaints by overseas companies and White House trade negotiators that China is using informal barriers to block foreign competition in the domestic market, even where written rules ostensibly guarantee fair treatment.

Although Visa and Mastercard submitted applications to the People’s Bank of China more than a year ago, the PBoC has not formally acknowledged these submissions, according to people familiar with the application process. In a typical Chinese permissions process, formal acceptance and acknowledgment is the initial step towards approval. According to the application procedure published in 2017, the central bank must decide on applications within 90 days of acknowledgment.

In November, American Express became the first foreign card scheme to win initial approval from the central bank to establish a renminbi bank-card clearing company. But Amex’s approval raised eyebrows because the new entity is a 50-50 joint venture with a Chinese partner, even though the rules permit wholly foreign-owned ventures. Reuters reported in November 2017 that China was pressuring Visa and Mastercard to operate through joint ventures. But an executive at a major foreign card operator said the PBoC had not explained its refusal to process the company’s application.

Visa and Mastercard’s efforts to enter China date back at least a decade. The WTO ruled in 2012 that China discriminates against foreign payment providers, nearly two years after the US government filed the complaint. In October 2014, China’s cabinet declared that it would open the market to foreign players. The cabinet published a more specific market entry framework six months later, and the PBoC followed up with rules governing bank-card clearing companies in 2016.

In June 2017, nearly five years after the WTO ruling, PBoC issued the application procedure for establishing such a business. Visa submitted its application in July 2017 and Mastercard followed suit later that year. The PBoC is the largest shareholder in China UnionPay, which maintains a de facto monopoly on renminbi bank-card payments in China. Visa, Mastercard, and American Express have partnerships with Chinese commercial banks to issue foreign-branded credit cards, but they are only usable for foreign-currency payments.

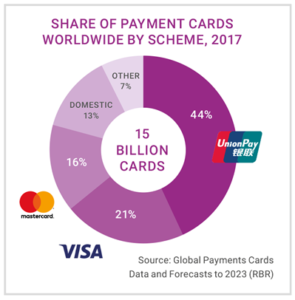

Chinese customers use such cards for international travel, but most domestic merchants do not accept them. UnionPay’s dominance in China helped it earn a 36% market share globally in bank card payments, compared to 32% for Visa and 20% for Mastercard, according to RBR. UnionPay has sought to expand its international business in recent years, first in emerging markets and more recently in Europe. Chinese payment card transactions totaled Rmb848 billion ($124 billion) in the year to September 30, 2018, up 11.5% from a year earlier, according to PBoC data.

Contributed by Magdalena A K Muir

References

Visa and Mastercard left out in cold as Chinese Central Bank refuses to process application

UnionPay stays on top as the world’s largest scheme